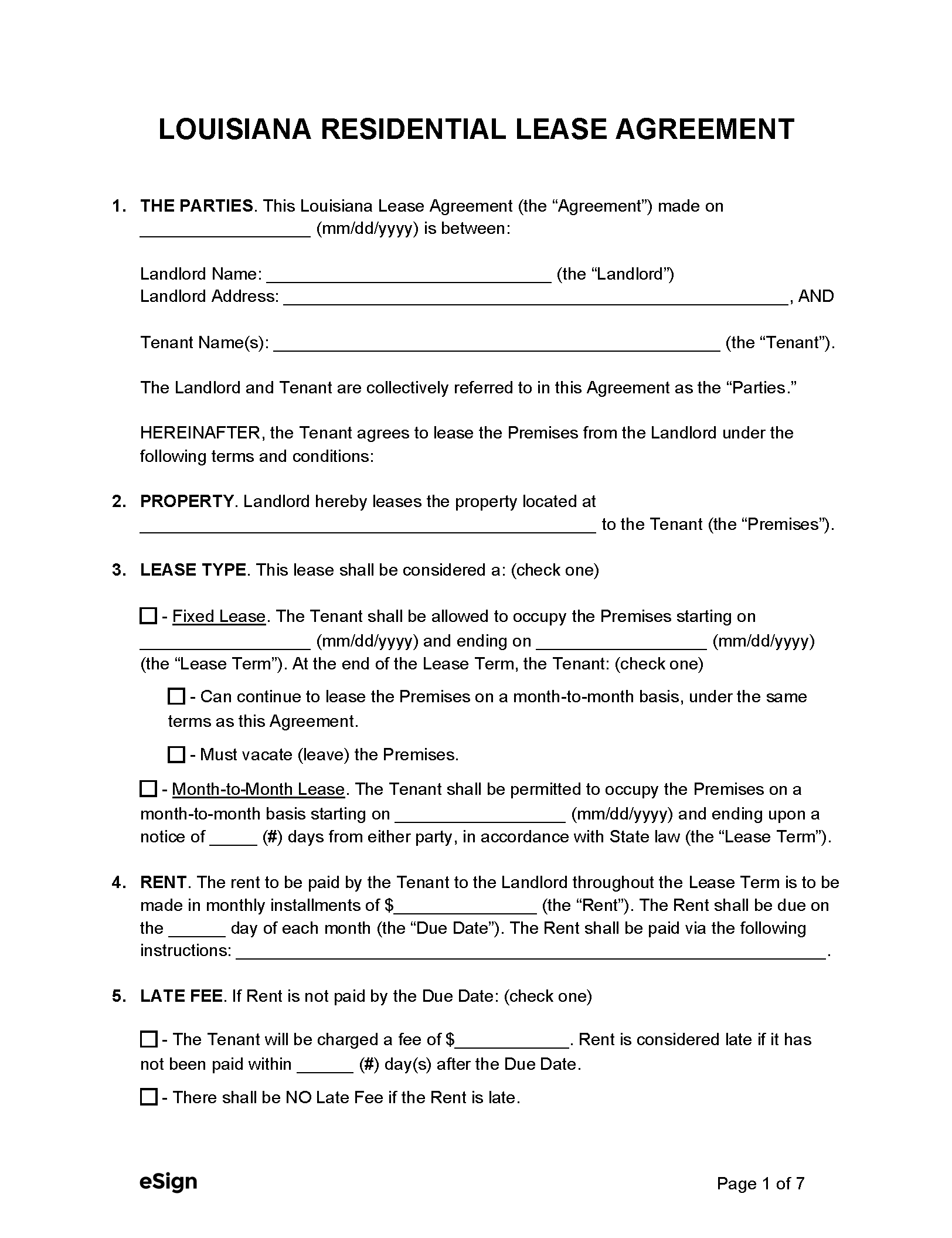

A Louisiana lease agreement is a contract formed between a landlord and a tenant regarding the rental of commercial or residential property. All rental agreements must conform to state laws and are invalid if they contradict legal requirements and limitations. Most leases renew automatically or allow the tenant to renew at the end of the lease’s term.

A Louisiana lease agreement is a contract formed between a landlord and a tenant regarding the rental of commercial or residential property. All rental agreements must conform to state laws and are invalid if they contradict legal requirements and limitations. Most leases renew automatically or allow the tenant to renew at the end of the lease’s term.

PDF Download

A Louisiana lease agreement is a contract formed between a landlord and a tenant regarding the rental of commercial or residential property. All rental agreements must conform to state laws and are invalid if they contradict legal requirements and limitations. Most leases renew automatically or allow the tenant to renew at the end of the lease’s term.

4.8 | 103 Ratings Downloads: 10,491

Rental Application – A rental application is used to obtain potential tenants’ personal and employment information to ascertain their viability for a vacancy.

Maximum Amount ($) – Landlords may charge any amount for a security deposit.

Collecting Interest – Interest doesn’t need to be collected on security deposits.

Returning to Tenant – A deposit must be returned to the tenant within one month of the termination of the lease. [2]

Itemized List Required? – Yes, the landlord must give the tenant an itemized statement explaining any deductions made to their deposit.

Separate Bank Account? – No, there is no state law that requires s ecurity deposits to be kept in a separate bank account.

General Access – There are no statutes requiring the landlord to give notice before entering a rental property.

Immediate Access – Landlords can demand immediate access to a rental unit in emergency situations.

Grace Period – Tenants are only given a grace period to pay rent if their lease provides one.

Maximum Late Fees ($) – There is no state limitation for late fees.

Bad Check (NSF) Fee – Landlords can charge tenants a $25 fee or 5% of the check amount for bounced checks. [3]

Withholding Rent – If the landlord doesn’t make necessary repairs within a reasonable time, the tenant can complete the repairs and demand reimbursement or deduct repair costs from their rent. [4]

Non-Payment of Rent – Landlords can evict tenants with five days’ notice if they don’t pay rent on time. [5]

Non-Compliance – If a tenant doesn’t comply with their lease, the landlord can give them five days’ notice to quit the property.

Lockouts – Landlords cannot change the tenant’s locks without notice or a court order.

Month-to-Month Tenancy – Month-to-month tenancies can be canceled with 10 days’ notice. [6]

Unclaimed Property – State law is unclear on what a landlord should do with any property abandoned by the tenant.